Financial Assistant: Directing You In The Direction Of Your Monetary Goals

Wiki Article

Discover Specialist Loan Services for a Seamless Loaning Experience

In the world of monetary transactions, the mission for a seamless borrowing experience is commonly demanded but not conveniently acquired. Specialist finance solutions provide a pathway to browse the complexities of loaning with precision and competence. By straightening with a credible finance supplier, individuals can open a plethora of benefits that extend past simple financial purchases. From customized funding options to personalized assistance, the world of professional loan solutions is a world worth discovering for those looking for a borrowing trip noted by effectiveness and convenience.Benefits of Professional Finance Providers

Professional loan solutions use know-how in browsing the complicated landscape of loaning, providing customized solutions to satisfy details monetary needs. Professional car loan services typically have developed partnerships with loan providers, which can result in faster approval processes and much better arrangement end results for consumers.

Picking the Right Finance Service Provider

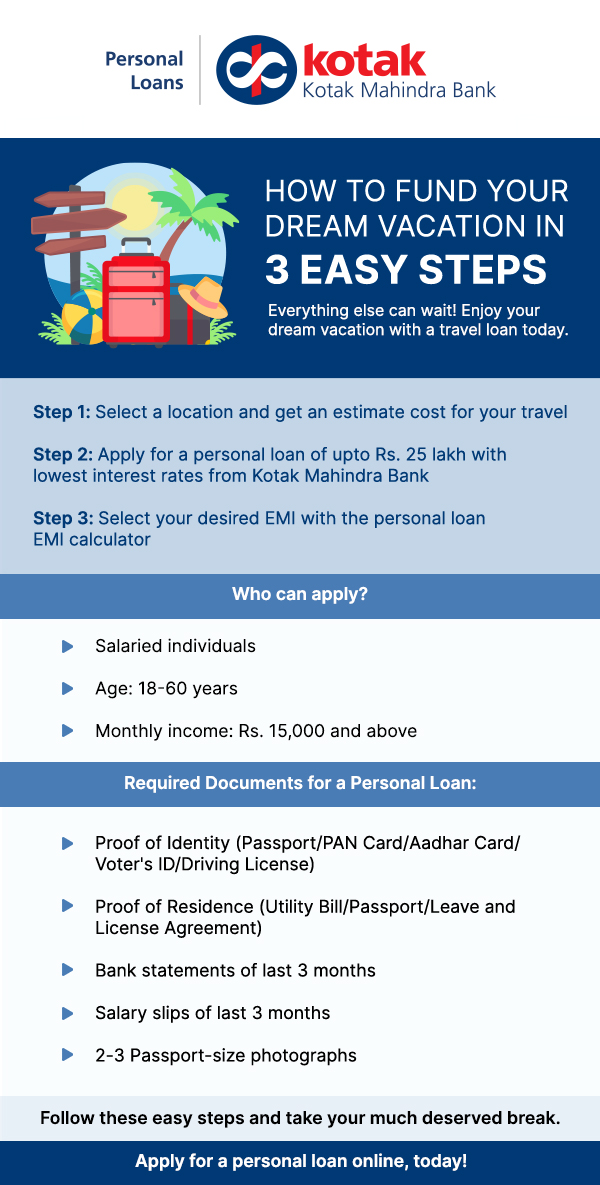

Having actually identified the benefits of specialist loan solutions, the next essential action is selecting the appropriate loan company to satisfy your certain monetary needs efficiently. merchant cash advance companies. When picking a finance provider, it is vital to take into consideration numerous crucial variables to ensure a smooth loaning experience

First of all, evaluate the reputation and reputation of the financing company. Study client reviews, ratings, and endorsements to evaluate the fulfillment levels of previous debtors. A reputable car loan carrier will certainly have transparent conditions, exceptional client service, and a track record of reliability.

Second of all, compare the passion rates, charges, and repayment terms provided by different car loan suppliers - mca lenders. Try to find a provider that supplies affordable rates and versatile repayment alternatives tailored to your economic situation

Furthermore, take into consideration the lending application process and approval duration. Go with a supplier that uses a structured application procedure with fast approval times to access funds promptly.

Improving the Application Refine

To enhance effectiveness and convenience for candidates, the funding supplier has implemented a structured application procedure. This refined system aims to simplify the borrowing experience by decreasing unneeded documents and quickening the authorization procedure. One key function of this streamlined application procedure is the online platform that permits applicants to send their info electronically from the convenience of their very own office or homes. By eliminating the demand for in-person brows through to a physical branch, applicants can conserve time and complete the application at their comfort.

Understanding Finance Terms and Conditions

With click to read more the structured application procedure in place to simplify and quicken the loaning experience, the following critical step for applicants is getting a comprehensive understanding of the financing terms and problems. Recognizing the terms and problems of a car loan is crucial to make sure that debtors are conscious of their obligations, legal rights, and the total price of loaning. By being knowledgeable concerning the finance terms and problems, borrowers can make audio financial choices and navigate the loaning procedure with confidence.Making The Most Of Car Loan Authorization Possibilities

Securing approval for a finance necessitates a critical approach and comprehensive preparation on the part of the customer. Furthermore, minimizing existing debt and preventing taking on brand-new financial obligation prior to using for a car loan can demonstrate financial obligation and improve the possibility of authorization.Additionally, preparing a thorough and reasonable budget that lays out earnings, expenditures, and the suggested car loan payment strategy can showcase to loan providers that the debtor can managing the additional monetary obligation (mca lenders). Providing all necessary documents without delay and accurately, such as evidence of income and employment background, can streamline the authorization procedure and infuse self-confidence in the lender

Conclusion

To conclude, specialist lending services supply numerous advantages such as professional guidance, tailored finance options, and raised authorization possibilities. By picking the right car loan supplier and comprehending the conditions, customers can simplify the application procedure and make sure a seamless loaning experience (Financial Assistant). It is necessary to very carefully think about all aspects of a car loan before committing to make certain monetary stability and successful settlementReport this wiki page